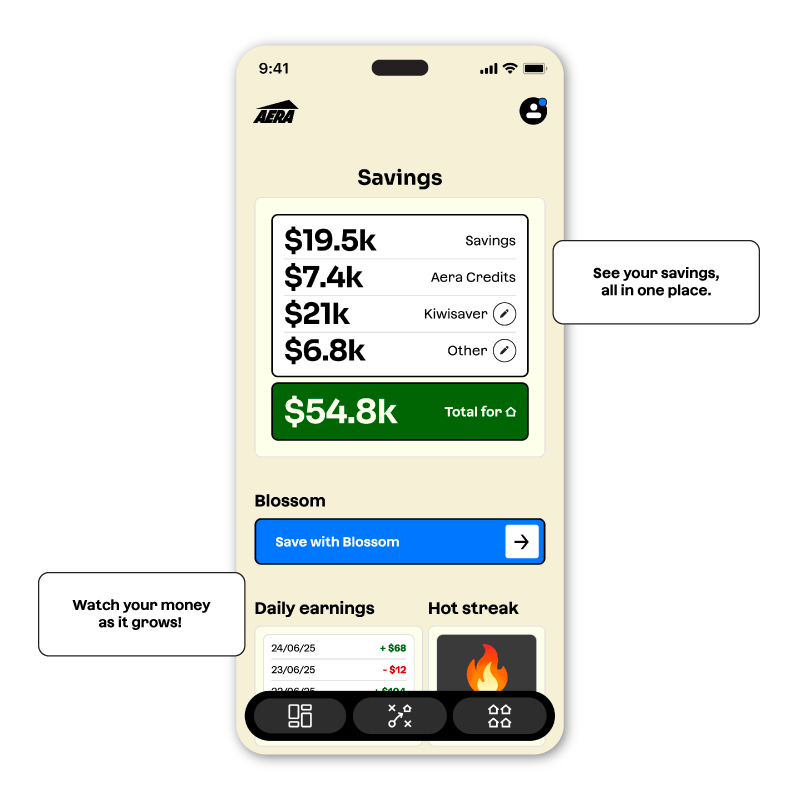

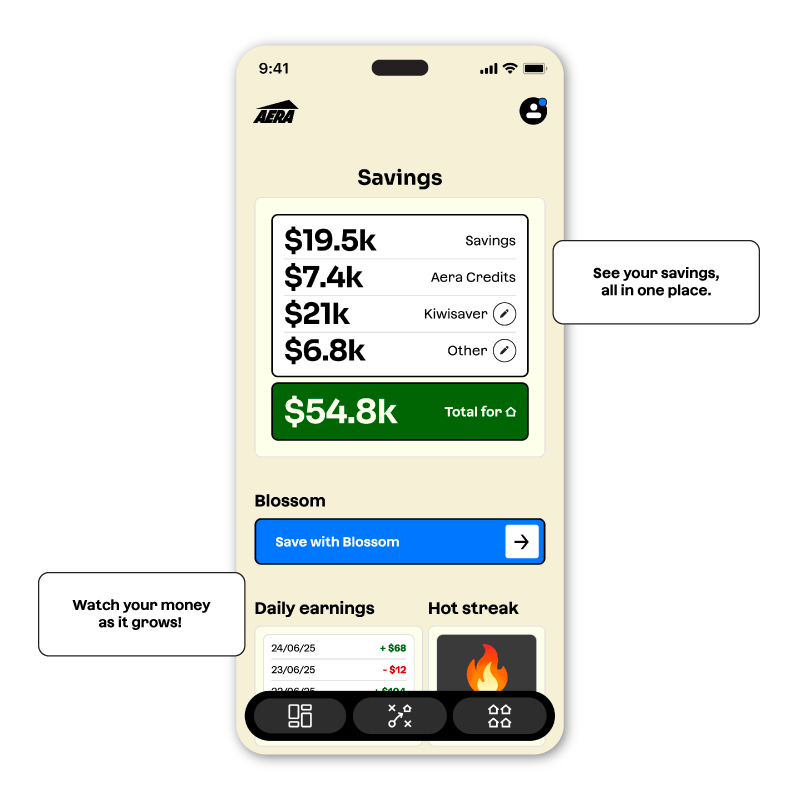

Save faster. Track it all in one place.

See your Aera Credits, KiwiSaver, savings, and Blossom account combined in one dashboard. Get an instant view of how close you actually are to your first home.

See your Aera Credits, KiwiSaver, savings, and Blossom account combined in one dashboard. Get an instant view of how close you actually are to your first home.

We are working with Blossom to help our members save for their home faster.

Continue through the app to access your savings information and keep on track with smashing that deposit goal.

Download

Get the Aera app to start unlocking $10k now.

Our Accelerated Accounts are locked in for a time period. To get your money out, all you need to do is give us notice and each account tells you how much notice you need to give - the 90 account needs 90 days, the Overnight needs overnight notice. We try to keep things simple around here.

Aera is not a registered bank. We are a financial services company that exists to help members get into their own homes, faster. For our savings products we help you access investment assets that earn higher rates. In the app you get to choose from a selection of account types, and can see what assets are held within them.

When you choose to put money into a Deposit Acceleratorthem, the assets and cash are held in a ‘nominee’ on your behalf, in your own name in trust. A nominee is a company that is nominated to hold assets on behalf of another entity. and are kept entirely separately from Aera the business. Whatever happens to Aera the company, all of your funds are entirely separate.

They aren’t bank accounts, but the assets you have your money in are a mix of cash, investment grade and funds which aim to get better returns than banks. It includes funds with some of the largest institutions in the world such as Nikko Asset Management (who manage over $50 billion of funds for people), and also are sometimes bonds which are debts owed by the largest companies in New Zealand like the owners of Mercury Energy or Z Energy, to you. It’s nice to know some of these big companies are working hard to make you money!

Yes they are. That’s why we called them Deposit Accelerators. They are targeted rates, and they can change but generally they are pretty stable and we let you know when things are going to change.

Aera’s app is built on banking software that’s used by over 15M global customers. Apart from tracking and hitting your first home milestones, you can move money in and out, control your debit card, change your PIN, send yourself and others money and much more. Your funds are held securely in trust and placed with large, reputable New Zealand registered banks and financial custodians that you select.

New venture to offer first home buyers higher annual savings rates.